Many of my friends in Mumbai often mention that they want to retire early! Some want to retire in their mid-40s, some right away, and some don’t mind working it out till the official retirement age of 60. And yet, while there’s a lot of talk, almost none of them have any idea what kind of money they will need at retirement, or have taken any concrete steps towards planning for it. Yes, some have started saving, but will that saving be enough is a question nobody is asking.

I’ve been doing wealth management for over two decades now, and my first course of action – almost always – is to recommend that clients build a financial plan for retirement. While other financial goals are not to be ignored, retirement planning is of paramount importance –and here’s why.

1. Retirement is both the farthest goal (in terms of time), and the biggest goal (in terms of value)

Let’s say Mr X who lives in Mumbai and is aged 43 has 2 financial goals.

a. Retirement at age 60

b. Post graduate education abroad for his only daughter (when he turns 51)

Now, planning for which goal is most critical and why? The simple answer is in the time and magnitude of the goal. The retirement goal is 17 years away while the education goal is 8. Furthermore, wealth accumulated for retirement must sustain for another 25 years (assuming a life expectancy of 85), while the wealth for post-graduate education must sustain only 2 years.

So, while Mr X has more time for retirement, any slip in the financial calculations towards his retirement goal can have a much more profound impact because of how much farther it is.

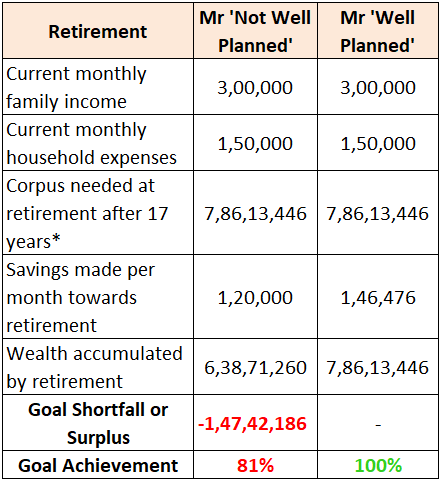

Here’s an illustration:

*Calculated by assuming monthly savings are invested @ 10% return (before & after retirement); inflation at 6 %

The above illustration demonstrates how a relatively small difference of Rs 26,476 in the monthly savings rate can create a massive shortfall of Rs 1.47 crores at retirement. This is because goals that are several years away see a manifold impact of compounding, both positively (on returns) and negatively (because of inflation).

2. There is no recourse or path correction if you get this wrong

If you don’t prioritize retirement planning, you don’t get a second chance. In the above illustration, if Mr X does get his planning wrong for the education goal which is 8 years away, he can course correct by either selling some of his existing assets or taking a loan. But if he gets retirement calculations wrong, what can he do? He can’t earn anymore, and therefore is unlikely to get a loan. There is also no time left to course correct. The only way out, then, is to compromise on one’s lifestyle and live more frugally for the rest of your living years.

So, if you’re still procrastinating about planning for retirement (or financial freedom), simply don’t! It’s imperative you get an accurate measure of what it takes to have a comfortable and compromise free retired life. If you feel you can’t do the numbers yourself, get professional help. But get it done quickly. A stitch in time will save you nine!

Rohin Pagdiwala

Founder – Pagdiwala Investments

AMFI Registered Financial Distributor, Mumbai

9820191834

How much is enough for early retirement?

Newlyweds can double their retirement corpus by starting early

9 Comments. Leave new

Couldn’t agree more. I have a financial advisor who has helped me immensely in planning for retirement and education of my 2 kids.

I always used to think finance is complicated but this article really simplifies it to the basics. Important and useful- please keep them coming

Thank you Rajiv

Thanks for your blog, nice to read. Do not stop.

An impressive share, I just given this onto a colleague who was doing a little analysis on this. And he in fact bought me breakfast because I found it for him.. smile. So let me reword that: Thnx for the treat! But yeah Thnkx for spending the time to discuss this, I feel strongly about it and love reading more on this topic. If possible, as you become expertise, would you mind updating your blog with more details? It is highly helpful for me. Big thumb up for this blog post!

Glad you are enjoying this. Will try and write more on retirement. Meanwhile you can go to https://www.pagdiwalainvestments.com/financialindependence/ and see my other blog articles, some of which are on early retirement

It?s actually a cool and helpful piece of information. I?m glad that you shared this helpful information with us. Please keep us up to date like this. Thanks for sharing.

You actually make it seem so easy along with your presentation however I in finding this matter to be actually one thing which I think I’d never understand. It kind of feels too complex and very huge for me. I’m having a look ahead to your subsequent publish, I will attempt to get the hang of it!

Thanks for the advice on credit repair on this particular web-site. The thing I would offer as advice to people is always to give up this mentality that they’ll buy currently and fork out later. As a society many of us tend to make this happen for many issues. This includes getaways, furniture, plus items we wish. However, you must separate your wants from the needs. While you’re working to improve your credit score you really have to make some trade-offs. For example you may shop online to save cash or you can click on second hand retailers instead of costly department stores pertaining to clothing.