Over the last 12-18 months, economies the world over have been battered because of the Russia-Ukraine war. The resultant oil supply disruptions and trade tensions have created shockwaves across both global equity and bond markets, along with unprecedented inflationary pressures. This in turn has forced several central banks to raise interest rates continually.

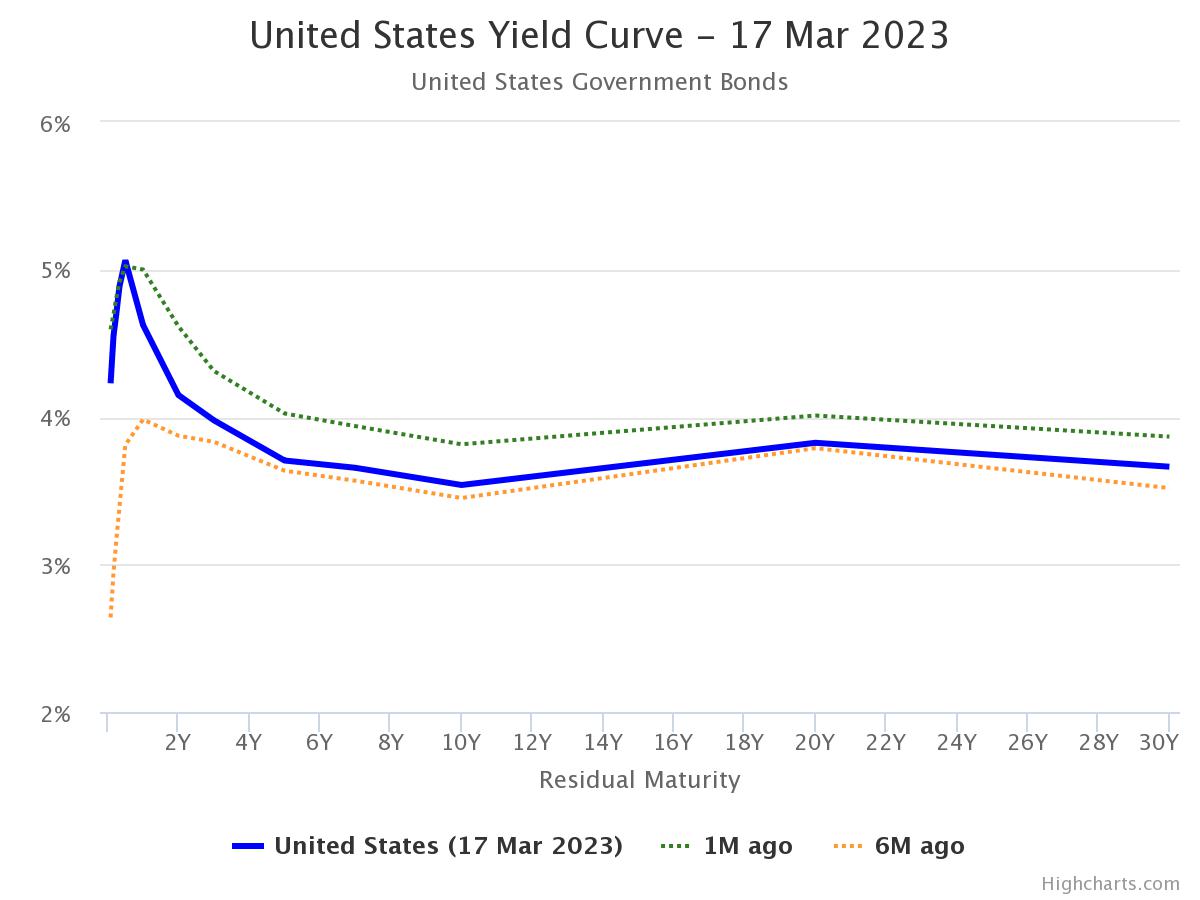

The US Federal Reserve has raised interest rates eight times over the last 12 months from 0.25% to 4.75 % now. Consequently, bond yields have risen sharply providing some unique investment opportunities for fixed income investors across the globe. It’s also noteworthy that the US yield curve is now ‘inverted’ meaning that you get more returns for lower tenors and lesser returns for longer tenors, an exceptional scenario.

One such unique investment opportunity is the recently launched IDFC US Treasury Bond 0-1 Year FoF. This Fund of Fund invests in JP Morgan BetaBuilders US Treasury Bond 0-1 Year UCITS ETF, which in turn invests in short term US Treasury Securities of the 0-1 year tenor, globally considered the safest of safe bets.

The 1-year US Treasury paper yield is at 4.6% while the 6-month paper is at 5.06% (as on 17th March 2023). If we add the standard INR-USD depreciation of 4% per year, an Indian investor could make 8 – 9% rupee returns over a 12 month period. This can be especially useful for parents who plan to send their kids abroad over the next 12-18 months and want to hedge against US dollar appreciation without immediately sending the money abroad through LRS. Investing abroad directly via the LRS route will soon involve heavy taxes with all overseas remittances set to face 20% tax collected at source from July 2023, making this IDFC fund a simpler choice. Further, this fund comes at a low expense ratio of 0.19% for the regular plan and 0.12% for the direct plan (including charges for the underlying ETF) making it a cost effective option.

Capital gains tax for this fund will be similar to any bond fund in India i.e., 20% with indexation benefit if held for more than 3 years. If redeemed earlier, gains will be added to income and taxed at the investor’s slab rate. All in all, the fund looks like an interesting option for risk averse investors.

But before considering any investments, one should note the potential risks associated with this fund.

First is the currency risk. When compared to domestic bond funds which are yielding 7.5% today, this fund can potentially offer close to 9% provided the key assumption that the INR will fall at least 4% in 12 months holds true. In 2022, the rupee fell over 10% to the USD. Since 2018, it has depreciated 23% in absolute terms over 5 years both of which serve as good indicators. However, currency markets can see some wild gyrations and if the war ends soon, we may see some reversal or stagnation in rupee fall.

The second key risk is the interest rate risk. It is widely expected that the US Fed will increase rates at least once more in the next few months. This might result in fluctuations in yields thereby impacting fund returns. And if the US Fed suddenly reduces rates, there can be mark to market gains for investors.

Keeping all the risks and potential gains in mind, this fund is a unique investment opportunity hitherto not available domestically. Risk averse investors could consider a small allocation to this fund from their portfolio if they want to hedge against the US dollar for the short to medium term, and have a 1 year investment horizon. However if the investment is for longer duration and if US dollar hedging is not needed, then risk averse investors can lock in money in target maturity funds which give indexation benefits. One should consult a financial planner before entering such a fund.

Rohin Pagdiwala

Founder, Pagdiwala Investments

Financial Planner & Distributor

info@pagdiwalainvestments.com

98201 91834