I recently had the pleasure of attending the wedding of a good friend. While the party was lavish and the night young, I couldn’t help but wonder if this newlywed couple and all their 30 something friends had any understanding of how to plan their financial future, especially with marriage ushering in a whole new set of responsibilities. I remembered some of the mistakes I had made when I was newlywed (financial mistakes that is :)) and I felt obligated to pass the learnings.

Here are some questions that come to my mind.

Do 30 something couples have any idea on how to plan their wealth? Do they understand the massive long-term future impact of their early investment choices? Do they have access to professional guidance in the form of a financial planner? And finally, what’s a good investment plan to build financial foundations on with a focus on early retirement?

The answer to a lot of these questions is in first understanding some simple financial concepts, and then in how significantly each of these can impact their future financial well-being and retirement.

1. Inflation

While almost everyone understands this, not many understand what to do about it. Data shows that the value of Rs 1 lakh in 1984 has become less than Rs 6,000 today. Similarly, @ 6% inflation, value of Rs 1 lakh today will be approximately Rs 18,000 by 2050.

What this means from an investment perspective is that whatever you invest in must at the minimum beat the 6% inflation rate (or whatever is the rate prevailing at the time), else you are losing money over time not growing it. Keep this in mind.

2. Compounding, the 8th wonder of the world !

Albert Einstein said this “Compound interest is the 8th wonder of the world. He who understands it, earns it. He who doesn’t … pays it.” He also referred to it as one of the greatest “miracles” known to man.

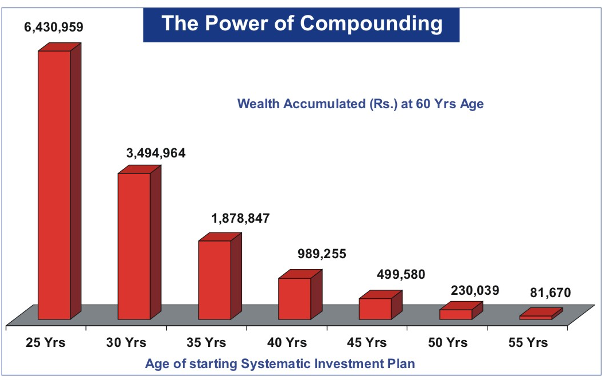

And yet not many people understand its power or choose to use it to their benefit. I have used the chart below to illustrate the impact of investing early in life on one’s retirement corpus. It shows the wealth accumulated at age 60 by saving Rs 10,000 per month at a return of 12% per annum.

You will see that those who start investing at age 25 accumulate almost double the savings as compared to those who start at age 30. And those who start at age 30 have nearly double that of those who start at 35. From an investment perspective, what this basically means is to start early and give your investments time, lots of it!

Chart 1 – Starting early really pays

SIP investment of Rs 1,000 per month; assuming return of 12% p.a.

3. Taking adequate risks

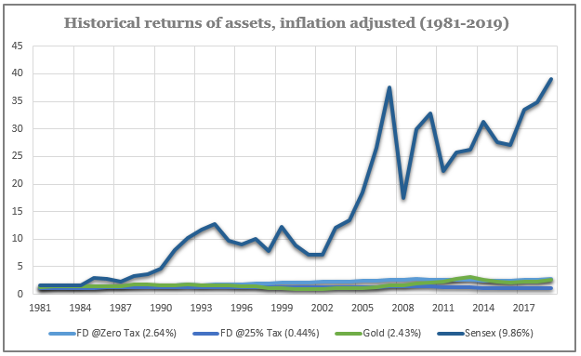

India is smitten by three investment options – Fixed Deposits, Gold & Real Estate. And yet with the exception of real estate, these are amongst the poorest investment choices to make. Fixed Deposits and Gold seldom beat inflation. And while real estate tends to beat inflation over the long run, it comes with low liquidity, low transparency and very high transaction costs (stamp duty etc.).

Chart 2 below shows inflation-adjusted returns of Gold vs FDs vs Sensex (equity) for Re 1 invested in 1981. As is obvious from the data below, taking risks by investing in equity is a necessity, not a choice. Those who continue to try to build wealth through FDs or Gold will see value erosion over time.

Chart 2 – Investing in equity is a necessity, not a choice if you want to become wealthy

The Bottom Line

Most young couples rarely think beyond their immediate financial needs, and I don’t blame them for that. It’s hard to plan for retirement which is about 30 years away. Yet that advance planning is exactly the thing that’s needed for some serious money making.

Here are 4 key ingredients to a good foundation

- Ensure you have a high savings rate (remember every extra saving of 10K per month can mean Rs 35 lakhs more at retirement if you start at age 30 – see Chart 1). So think hard before you blow up that 10K at a night out.

- Give investments time, lots of it – Starting 5 years earlier can double your retirement wealth

- Take adequate risks – Investing in FDs or Gold never made anyone rich. Take adequate exposure to equity if you want to grow wealth.

- Buy a house only if you plan to live in it – Don’t go investing in property unless you plan to stay in it. Property investments will generally yield lower returns than equity, and are mired by low liquidity and lack of transparency.

Morgan Housel in his book The Psychology of Money said this – “Financial success is not a hard science. It’s a soft skill, where how you behave is more important than what you know.”

This couldn’t be more relevant for young couples or even young individuals. It’s finally not always about how much you make, but about how you behave with your money that will decide how wealthy you become.

So, if you’re still procrastinating about financial planning, simply don’t! All it takes is 30 minutes to get a plan in place. And if you feel you can’t do the numbers yourself, get professional help. A stitch in time will save you nine!

Rohin Pagdiwala

Founder – Pagdiwala Investments

AMFI Registered Financial Distributor, Mumbai

9820191834

6 Comments. Leave new

Thank you Rohin for sharing this valuable info

Am glad you find it useful

🙌🙌🙌🙌 super informative 🙂

Thanks

Thanks Rohin for sharing this… Very informative…

Thanks Quaid. Hope you are well.