Many of you may not even know what your investment mix is. Yet it’s probably the most important part of financial planning and the first question you must ask your financial advisor!

Investment mix is also called Asset Allocation in financial parlance. All it means is: You invest in different things. Stocks are volatile. Fixed deposits are safe. Bonds are somewhere in between. Bitcoins are crazy. Gold is anywhere. How much should you invest in each? That’s your investment mix or Asset allocation.

Most investors don’t spend any time looking at this. Instead they spend an inordinate amount of time chasing what is called alpha, the extra return you can get over and above a market index (like the Sensex) or some other broad benchmark that it is compared against. This generally has a <5% impact on overall wealth creation.

Instead what we really should be spending our energies on is Asset Allocation. And here’s why.

Asset Allocation drives 91.5% of portfolio returns. The balance 8.5% comes from other factors like market timing, security selection, etc. (see details below). Your Asset Allocation choices will make or break your portfolio performance and in turn your long term wealth creation ability.

What drives investment return over the long term?

- 4.6% Security Selection (which stock, which fund etc.

- 2.1% Market Timing (when to buy, when to sell)

- 91.5% Asset Allocation

- 1.8% Other Factors

So what should your mix be?

Well there is no right or wrong answer to this. It needs to be personalized for you after looking at a multitude of factors like your risk taking appetite, your income, existing family wealth, no. of dependents, loans & EMIs, goals that you have in mind, age, etc. No one mix is right for Jack and wrong for Joe. It needs to be planned carefully with an experienced financial advisor.

Why is it so important?

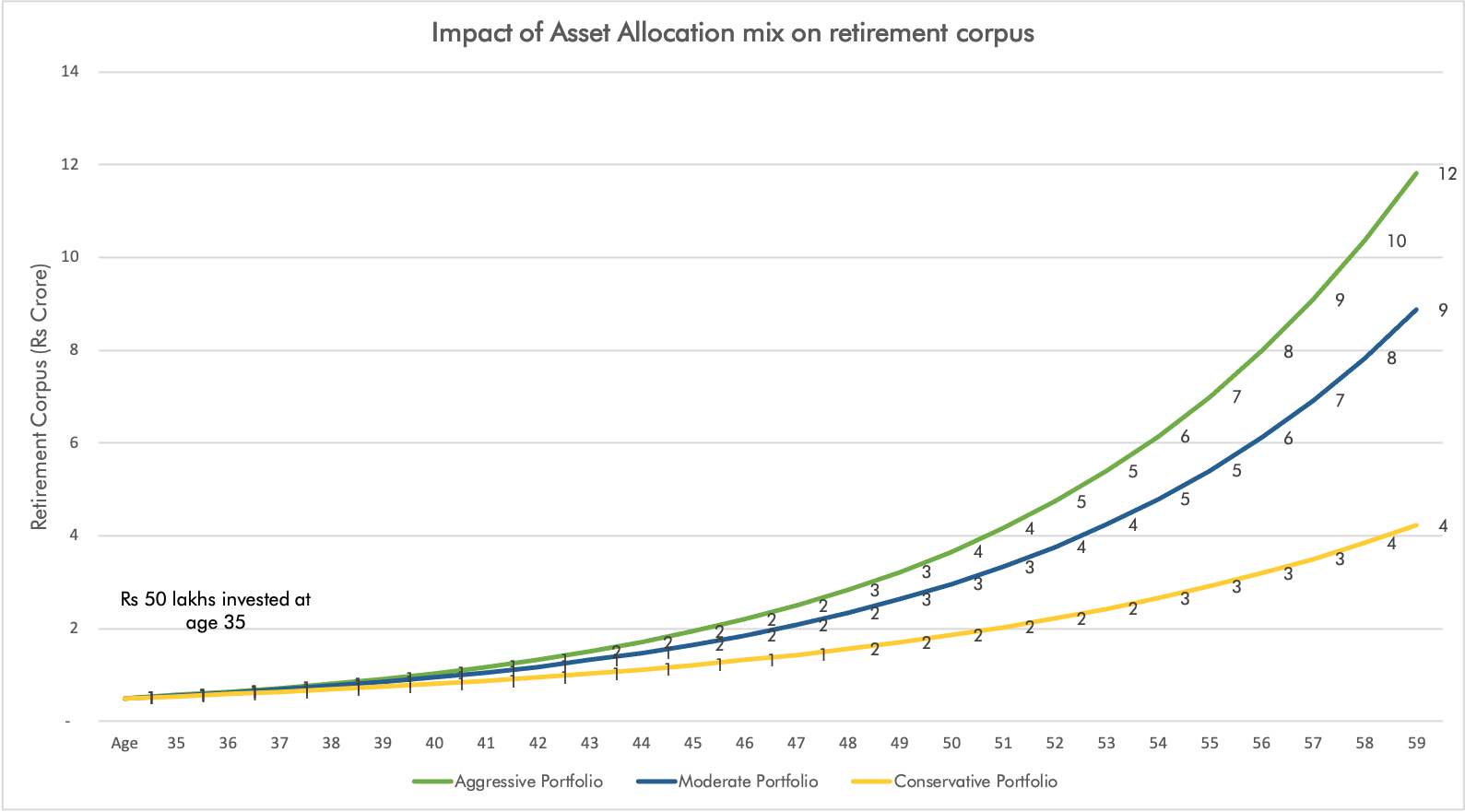

To give you a sense of how important this really is, I’ve put together an illustration that demonstrates wealth created at age 60 for someone who had invested Rs 50 lakh at age 35. I’ve looked at investments made under three different scenarios with three different asset allocation models as detailed in the table below:

| Equity | Fixed Income | Gold | Real Estate | Total | |

| Aggressive | 75% | 10% | 5% | 10% | 100% |

| Moderate | 50% | 20% | 10% | 20% | 100% |

| Conservative | 10% | 40% | 15% | 35% | 100% |

I’ve then used past returns of each asset class* to extrapolate what would be the wealth created at age 60 under each of the three scenarios.

If one had followed the Aggressive portfolio, wealth accumulated by retirement age would have been Rs 12 cr. Conversely investment in the Conservative portfolio would have yielded Rs 4 cr, a difference of a whopping Rs 8 cr or 180%.

*Equity @ 14.5%, Fixed Income @ 8.3%, Gold @ 4.5% and Real Estate @ 7.5% based on data compiled over last 10 years

Do note that in practice the investment mix will (& should) change over time thereby giving slightly different outcomes. However my point is for you to understand it’s significance and spend adequate time discussing it with your financial advisor and optimizing it every year. If needed, I am happy to offer a free portfolio review to my readers to help get this mix right.

Some of the key benefits of a portfolio review are:

- Identifying overlapping investments

- Identifying underperforming investments

- Utilizing idle money

- Tax saving

- Identifying the right asset allocation mix

- Managing risk through diversification

- Improving overall portfolio performance

- Defining financial goals

To conclude, if you don’t know your asset allocation mix, spend a couple of hours with your financial advisor to get it right. It will potentially have more impact on long term wealth creation than the countless hours spent at office.

Cheers & Good luck!

Rohin Pagdiwala

Founder – Pagdiwala Investments

AMFI Registered Financial Distributor, Mumbai

9820191834

More on retirement financial planning…