Are you constantly spending time managing your own money? Are you worried that your investment mix is not optimum and requires constant change? Read on to learn more about how to build a robust long-term hands-free investment portfolio that is designed to continually generate wealth as well as beat inflation.

Understanding your asset classes

Different asset classes in India tend to perform differently at different points of time. Most investors in India will have a mix of Equity, Real Estate, Debt and Gold in varying proportions in their portfolio with the bulk of them likely to be over invested in Debt (through Fixed Deposits), Gold and/or Real Estate. Yet the opportunity to make wealth really comes from taking risks through equity investing.

Before trying to build your portfolio either on your own or through a financial distributor, one must first understand some simple concepts about these asset classes and what they are best suited for

- Equity: Best suited for higher returns, especially in an economy like India which potentially has decades of high growth ahead of it. Equity is the only asset class in India which has consistently beaten inflation over time. Post-tax returns have been 12-16% CAGR over the last decade.

- Debt: Best suited for stability and steady income. Debt includes investments in Fixed Deposits, Small Savings Schemes, Bond Mutual Funds, etc. Post-tax returns of FDs have been < 5% CAGR* over last decade.

- Gold: Works well in turbulent markets and in times of economic, financial or geopolitical crises. Tends to give low returns otherwise. Post-tax returns of 4% CAGR over last decade.

- Real Estate: Contrary to popular belief, post-tax returns from real estate (as measured by the RBI Housing Index) have been below the 6% threshold of inflation (5.40% CAGR to be more precise). This asset class also comes with high maintenance costs, albeit it does offer 2-3% rental yield. Best suited to live in, not to invest in.

What to watch out for

Once you’ve understood what asset class is suited for what purpose, it becomes fairly simple to build your own all-weather portfolio. However there are 5 important considerations to keep in mind.

- Your overall portfolio must beat inflation at an aggregate level else you are effectively losing money, not making money. The only way to do this is to have sufficient exposure to equity.

- Use a mix of uncorrelated asset classes to minimize risk: When you start building the portfolio, use a mix of assets that have low correlation with each other e.g. Equity & Gold, or Equity & Bonds. Equity plays the role of driving growth whereas bonds bring stability and steady income. Using a mix of uncorrelated or low correlation assets can help protect the downside during times of extreme volatility.

- Use Gold as a hedge: Gold is largely uncorrelated to equity and tends to work well in turbulent times which protects the portfolio when markets see sharp corrections, usually in times of economic, financial or geo-political crises.

- Diversify adequately: Build a well-diversified portfolio that avoids sector biases in equity, maturity biases in bonds and so on. Consult a financial or a mutual fund distributor if you can’t do this yourself.

- Build the portfolio in a phased manner: Since a bulk of your portfolio is likely to be in equity assets, it is important to build this gradually by buying small amounts at regular intervals so that you average out your purchase price.

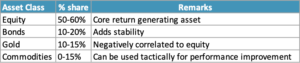

Here is how a model all-weather portfolio in 2022 could look like

Readers are cautioned to consult a financial or a mutual fund distributor if they do not have the confidence or knowledge to build this on their own.

Quick tips if you are doing this yourself

- Use balanced funds or multi-asset funds as far as possible as the fund manager can tactically switch between asset classes

- Use SIPs/STPs to build out your equity investments in a phased manner

- Review your asset allocation mix every 6 months to account for market fluctuations

- Seek help from a financial distributor / mutual fund distributor or financial planner if you are not confident of doing this yourself. Don’t be penny wise pound foolish.

What can you expect after building this portfolio

Over the long term, we can expect such a portfolio to comfortably beat inflation. However, do not expect returns that mirror or better the returns from equity indices like the Nifty. Since the portfolio uses a mix of assets, return expectations should also be balanced in the range of 8-12% annualised.

Rohin Pagdiwala

Founder – Pagdiwala Investments

AMFI Registered Financial Distributor, Mumbai

9820191834

*estimated for highest income tax slab